- 18Jul2018

-

Value Investing is More Than Warren Buffett. Here’s What You Should Know

Value investing is a common phrase used in stock investing. The term would sound like a sophisticated scheme to beginners in the stock market. It becomes more intimidating when you find out that the success of Warren Buffet was due to value investing. However, the strategy is not for the exclusive use of the high-profile billionaire. New investors can learn more about it and adopt it as their style of investing.

Value Investing defined

Value investing is not the brainchild of Warren Buffet. He is a disciple of its founder but he perfected the strategy to amass his fortune. Benjamin Graham is the person that brought the concept to the investment sphere.

By definition, value investing is an investment strategy whereby you pick individual stocks or equity issues that trade for less than their intrinsic values. Traders who use this approach are called “value investors.” They are constantly on the lookout for stocks they deem as undervalued by market standards.

This type of investors holds the belief that stock price movements are dictated more by news about the company rather than its long-term fundamentals. When the market reacts to favourable and unfavourable news items, it opens up buying or selling opportunities and profit potential.

Value differs from price

For newbie investors, it is important to have a better understanding of value and price. In value investing, value and price do not have the same meaning. Value investors buy the stocks at a price they think do not match up with the true worth of the company.

Based on that reasoning, they’re actually buying the stocks at a discounted price and therefore chances of an upside are stronger. They stand to gain in the future as the stock prices will eventually increase as it seeks to attain their real values.

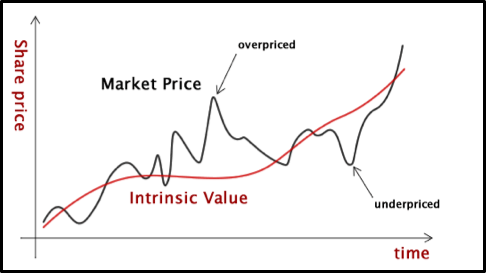

To put it in simple terms, this is how the value and price are differentiated in the context of value investing:

Intrinsic value

This is an estimate of a particular stock’s worth or the actual value of the company that encompasses all aspects of the enterprise. An intrinsic value is arrived at by using a combination of qualitative and quantitative analysis.

It is figured out based on the following: business model, market factors, review of financial statements, and ratios (profitability and valuation). Hence, it differs from the market price in that it represents the per-share value of the underlying business.

Market price

This is the going price of a particular stock being traded in the stock market at any given period. At times, the market price volatility will inexplicably push a stock’s price below its intrinsic value. Value investors hope for or find it an excellent investing opportunity.

The importance of intrinsic value

There are several variables that can influence stock evaluation. But for value investors wishing to purchase a stock, the starting point is finding out the intrinsic value. It is an important aspect of their selection process. Technical analysts frown at the approach for being unscientific.

The primary objective of value investors is to buy a stock when its market value or stock price is less than its intrinsic value. In the stock market, prices are always fluctuating, moving up, down or sideways. The prices appearing on the exchange are necessarily the actual value of a company. Sometimes, favorable or unfavorable news items can prompt price spikes and dips without having any correlation to a company’s worth.

Source: VintageValueInvesting

When the shares of a company are trading at a price lower than its intrinsic value, it is considered undervalued. Value investors earn profits by buying stocks of companies that are fundamentally sound, meaning earnings are stable or growing. These listed companies that possess such characteristics are regarded as value stocks.

Value stocks

Stock traders across global exchanges have followed or are following the value investing strategy popularized by Warren Buffett. In Singapore, the concept is also widely held. At the beginning of each year, a Value Investing Summit is held in the Lion City. The summit was hosted by the Value Investing College, which is also run by the well known local value investor Sean Seah. Seasoned and newbie investors converge to gain or enrich their knowledge on value investing. Attendance is rising annually.

Identifying value stocks

A value stock refers to a stock that is currently undervalued. It signals a buy call given the ‘bargain-price’ level of the stock compared with industry peers or counterparts.

A value stock can be spotted if the following factors are present:

- There is negative publicity resulting from worse-than-expected earnings reports or legal/regulatory issues linked to the company

- The company is long-standing with stable dividend payouts but undergoing damaging events. If the company has a high-dividend yield, it’s also an indicator.

- Companies with low price-to-earnings ratio (P/E) are considered good buys by value investors. Usually, companies operating in an industry where the nature of the business is cyclical show low p/e ratios at the time they are overvalued.

Value stocks are not risk-free

One vital factor is to keep in mind is that value stocks are not risk-free. There is always an attendant risk when investing in the stock market. Many investors find value stocks riskier than growth stocks. There is skepticism with value stocks.

In order make profits from a value stock, the negative perception brought by the adverse publicity needs to be overcome first. This is the underlying risk for value investors. But a value stock has a higher long-term return eventually.

As an investor, the holding period must be taken into account. It might take longer for a value stock to rise above its or it may never occur at all.

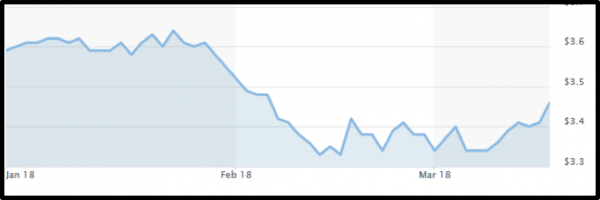

There are stocks in the Singapore Exchange Limited (SGX) that are trading near their respective 52-week lows. A clear example is Singtel. The telecommunications company has sound long-term prospects yet its shares are being beaten down resulting in short-term tumbles.

Singtel 10 YTD Chart as of 03/16/2018

Source: MarketWatch

Singtel is an established company in Singapore but investor interest seem pretty low at the moment. By following a simple metric like the return on invested capital (ROIC), a high ROIC means the business is of high quality. As of FY 2017, Singtel posted an ROIC of 24.7%. For every dollar of capital invested in the business, the telecom earns 24.7 cents in profit. Their ROIC is above average compared to other companies.

This example is not a recommendation to buy Singtel shares. It simply highlights what value investing is all about. Every time the stock price of a fundamentally sound business enterprise drops is an investment opportunity for value investors.

The margin of safety

Value investors go against the tide of the stock market. They insist on buying shares of companies whose prices are considerably lower than their intrinsic values. That is the lesson handed down by Graham to Buffet.

Graham introduced the margin of safety component. Value investing follows a process. First, estimate the intrinsic value of the company. Then evaluate and compare the stock price with the intrinsic value. Lastly, buy when there is a reasonable margin of safety.

What Graham is saying is that value investing is not speculative for as long as there is an in-depth analysis, a promise of capital preservation, and an acceptable return.

In reality, value investing is just one of the many strategies in stock investing and comes with its own set of pros and cons. “Value investing is a well proven path, and many great value investors in the world have done very well for themselves and their clients over an extended period of time. But, it can also be a very painful investment strategy,” said TJ Tan, CFA, from DCG Capital. DCG Capital’s Asian Value Fund adopts a value investing strategy when selecting companies for its fund.

“There will be significant periods of underperformance. Studies on large cap value stocks in the US compared against the S&P 500 showed that large cap value stocks underperformed the index by 51% for a rolling 3 year period. But over longer periods of 5 years and 10 years, the former outperformed the index by 51% and 60% respectively. Regardless of the time horizon and assuming no implementation mistakes, the average value investor can expect to look bad half the time.”

“It takes time, energy and discipline to study companies and do in depth research,” said Tan.

Click here to read the original article.

This is a guest post by ZUU Online, an Asian-based Finance Education Portal aimed at helping individuals to improve their knowledge on personal finance and money, through educational articles on business, investments, property and insurance.

Visit www.nebafinancialsolutions.com to see our Structured Products and UCITS Funds https://www.nebafinancialsolutions.com/Risk-Rated-Portfolio-DFM, https://www.nebafinancialsolutions.com/real-asset-fund

- 18 Jul, 2018

- NEBA Financial Solutions

- 0 Comments

Comments