- 21Feb2018

-

The Basic Guide To UCITS

What is a UCITS Fund?

The acronym UCITS stands for Undertakings for Collective Investment in Transferable Securities. Essentially, UCITS are investment funds regulated by the European Union. They are perceived as safe and well-regulated investments and are very popular in Europe, South America and Asia among investors who prefer not to invest in a single public limited company but rather among diversified unit trusts spread out within the European Union.

History of UCITS

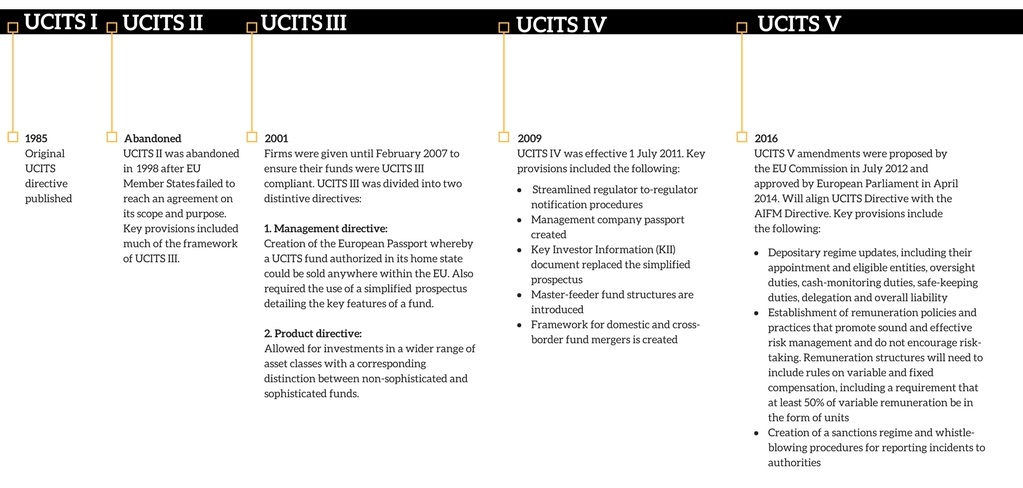

UCITS came about from a 1985 EU Directive that aim to standardise the rules and regulations across Europe regarding open ended funds and transferable securities. The plan was to make funds approved in one country, easy to market and sell to investors throughout the European Union.

In the early 1990s, proposals for modifications to the directive were made but never fully adopted. As such, there is no UCITS II. However, in 2002, following discussions among member countries, 2 new Directives were adopted. Directives 2001/107/EC and 2001/108/EC, together known as UCITS III, broadened the investment spectrum of UCITS funds and eased some restrictions for index funds.

UCITS IV, or Directive 2009/65/EC, brought about further technical changes and was introduced in July 2011. Finally, UCITS V, or Directive 2014/91/EU, which went into force in March 2016, aligns fund depositories’ duties and responsibilities and fund managers’ remuneration requirements with those of the Alternative Investment Fund Managers Directive (AIFMD).

Following the introduction of the UCITS law in 1985, the amount of UCITS funds has increased rapidly along with the amount of assets in these funds. According to European Fund and Asset Management Association (EFAMA), in Europe, investment funds have risen to over €15 trillion as of Q3 2017. These net assets represent over €9 trillion in UCITS funds and these assets are held in over 31,000 UCITS funds.

UCITS now account for around 75% of all collective investments by small investors in Europe.

The UCITS Directive has been the key to the development of the European investment fund industry. However, the success of UCITS has not been limited to the EU. The strict legal requirements to setup and manage a UCITS combined with its overwhelming success in Europe causes other countries outside Europe to take notice as well. Today, UCITS funds are distributed all over the world and offer a wide range of investment choices and high level of investor protection. These investor friendly mandates make UCITS funds a logical investment choice for both institutional and retail investors.

Why invest in UCITS Funds?

1. Diversification

“Don’t put all your eggs in one basket” is an age-old investment advice to avoid the risk of holding or relying on one asset or type of asset. UCITS make it easy to spread any risks or diversify as they minimize the danger of investing in a single security. Even with a small amount, you can have access to a diversified portfolio of assets, something which is not possible with direct investment.

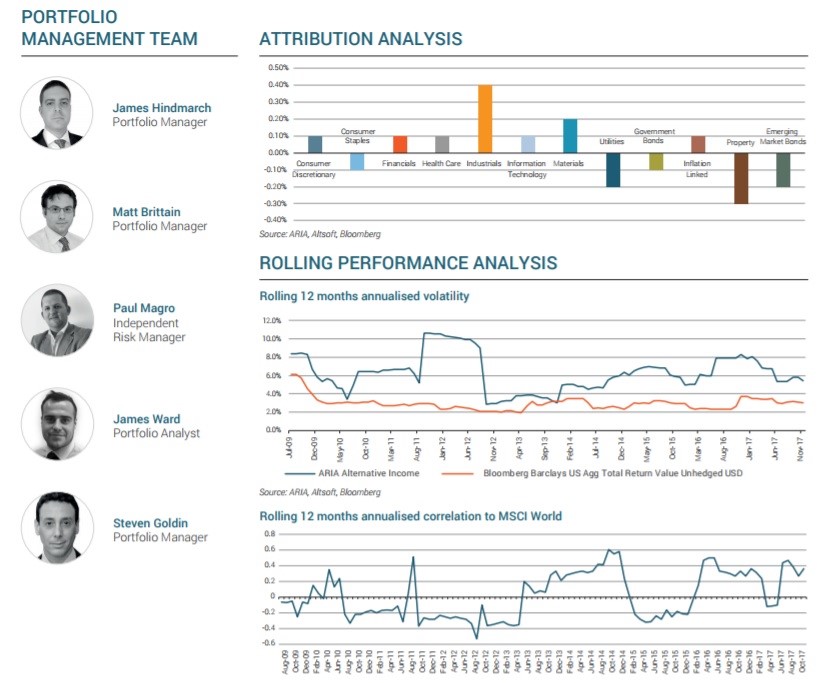

2. Portfolio Management

Another benefit of UCITS is a professional portfolio management. Investors will have access to the expertise of skilled fund managers, which would be very difficult and expensive for most investors to acquire for themselves. Fund managers will invest the money they received from the investors in line with the UCITS strategy. They decided which securities to buy and sell and when is the best time to do it. The investors get to sit back and relax and leave the task of buying securities to the experts.

3. Liquidity

One of the key characteristics of UCITS is the ease of buying or selling a fund’s share or units. This means that investors who wish to sell their holdings in a fund, whether because they believe the value may fall or for any other reason, can do so without delay. The cost or proceeds correspond to the value of the investor’s share of the fund assets, subject to any fees and commission charges.

4. Transparency

UCITS funds are required by EU Member States to report comprehensively to investors on their portfolio holdings and to produce at least a fortnightly net asset value, as well as annual and semi-annual financial reports.

The factsheet of a UCITS fund must be clear to the investor and must include relevant risk warnings, investment restrictions and disclose conflicts of interest. You can view NEBA’s RAF Fund factsheet here.

If you guys have not yet heard, NEBA now offers UCITS V funds that pay commissions – the first of its kind! Click here to read more about our RAF Fund.

Visit www.nebafinancialsolutions.com to see our Structured Products and UCITS Funds https://www.nebafinancialsolutions.com/Risk-Rated-Portfolio-DFM, https://www.nebafinancialsolutions.com/real-asset-fund

- 21 Feb, 2018

- NEBA Financial Solutions

- 0 Comments

- Assets, EU, Europe, European Union, Funds, Investment, Liquidity, Market, Portfolio Management, Transparency, UCITS,

Comments