- 24Oct2019

-

Do I like 95% Capital Protected Structured Products??

Don’t we have a duty of care to our clients??

Questions surrounding Capital Protected investments get sent our way every month without fail.

The answer to this particular one is: “No I do not?”

The reason is quite simple. The amount of potential return is impacted too much for protection, which in most cases, cannot justify the cost. I will attempt to break down my concerns one at a time.Miselling

Have you ever read the book “Story Selling for Financial Advisors”? If not, I recommend it. It teaches the power of adding stories to your selling pitch. The problem is that IFAs are sometimes sucked into the story themselves by some handsome salesman/woman who plays on their emotions with a good story behind a product and flog the junk on the back of that story to their clients. Then when everything goes not as hoped, they scream and shout and accuse the provider of misselling.

As sales people ourselves, you’d think that we’d be immune to such stories and be able to fact check the information to see if it backed up the story. What is most likely to happen? What are the risks? Too often we only hear the “best case scenario” and act like American Rupublians or Democrats and are blinded to anything except the side of the story we want to hear.

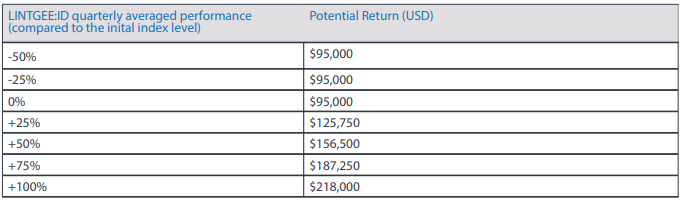

You’ll be shown a Fact Sheet with infomation showing a potential to double your money. But will the FTSE actually go up 100% in the next 5-6 years???? It is often said that the FTSE goes everywhere and nowhere.

Low Return

If the return is based on the performance of the FTSE, you’d have to be pretty confident that the FTSE would be going up. Otherwise you’d be better keeping your clients money in cash for 5 years.

The Graph below shows the last 5 years FTSE perfomance. If the 95% capital protected products out this month (Oct 2019) had started 5 years ago, this would be less than 2%pa to the client.

Automatic Loss

From the start the client is on the back foot with a 5% loss to make up even if the underlying asset breaks even. Does the client know that he loses 5% the second he invests? Do you? However, 95% Capital Protection sounds a lot better than “5% Loss which hopefully you’ll get back if the investment works”.

Unless you are sure the FTSE will go up 25%+ I think there are far better and safer products.

Real Capital Protection

Capital Protection is only as good as it describes in the detail. So be sure to check the full details and what it is you actually get rather than listening to a story selling sales person.

https://nebablog.com/2018/08/13/100-capital-protection-myth-or-real/

But there are Capital Protected Investments out there with Merit. Read the detail on our 90% Capital Protected Investment. Clients get back 100% not 90% and we are introducing a longer 5 year term version shortly.

https://nebablog.com/2019/05/16/what-clients-want-but-why-dont-ifas-buy-this/

So what do I think is better??

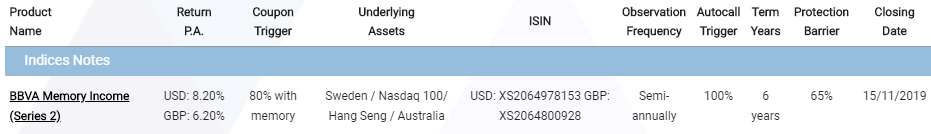

Something like this has probably more protection even though it has a protection barrier. If the last 30 years are anything to go by, this would have returned 100% of the Capital and at least some coupons if you’d started this product at any point in the past 30 years. Most of the time you would also have received 100% of the return too (depending on when you invested in the past 30 years).

More likely to have a higher return too!

NEBA are happy to help put a balanced portfolio together to fit the clients attitude to investing.

Visit www.nebafinancialsolutions.com to see our Structured Products and UCITS Funds

Share this:

- 24 Oct, 2019

- NEBA Financial Solutions

- 0 Comments

Comments