- 19Jul2018

-

Comparing Institutional and Retail Investors

When it comes to investing, you probably have come across the terms, ‘retail investor‘ and ‘institutional investor‘. The differences between the two dictates not only the size of the trades they make, but also the types of companies and financial instruments in which they invest their monies. So let’s compare them both.

The term ‘retail investors’ is synonymous with ‘individual investors.’ The majority of retail investors buy and sell stocks in round lots, where a round lot refers to 100 shares. This is not to say an individual can’t place an order to buy or sell 50, 25, or even just a single share of a company’s stock, but it often isn’t cost effective to do so because of the commissions that must be paid. It would be foolish to buy one share of a stock that was selling for $10 a share if the fee to do so is almost that amount, for example.

Institutional investors on the other are just what the name implies: large institutions, such as banks, insurance companies, pension funds, mutual funds, and exchange-traded funds (ETFs), that make heavy investments in the stock markets generally for a prolonged period of time.

In contrast to retail investors, institutional investors engage in block trades, which is an order to buy or sell 10,000 or more shares at a time. As might be expected, a large trade by an institutional investor can significantly affect the price of the security being bought or sold.

This being said, most institutional investors are not big players in the market for the stocks of the smallest companies; that market is largely left to retail investors, who are often attracted to invest in smaller companies because they are more affordable. An individual investor may be able to afford to invest in a diversified portfolio of 10 to 20 stocks in the $5 to $20 price range, while he might have trouble affording even one round lot of a stock with a 3-digit price tag.

Institutional investors, who trade 10,000 or more shares at a time, tend to avoid investing in smaller companies that are selling for less than $10 a share. This is mainly because these big-investors are investing large sums of money when they opt to purchase shares of a company, and a significant number of investment dollars directed to a smaller firm could result in the institutional investor’s acquiring a high percentage ownership of the company. This adversely affects the liquidity of the investment—i.e., the institution’s ability to sell the shares on the market place for little or no loss in value when and if it chooses to do so. And, for some institutional investors, it’s a violation of securities laws to do so.

For example, mutual funds, closed-end funds, and exchange-traded funds that choose to register as diversified funds must meet the diversification requirements outlined in the Investment Company Act of 1940, which restricts the percentage of a single company’s voting securities that these funds can own.

Both retail investors and institutional investors invest in bonds, options, and futures contracts as well as in stocks, but some markets, such as the swaps and forward markets, are primarily institutional investor arenas, largely because of the nature of the instruments and/or the manner in which transactions take place.

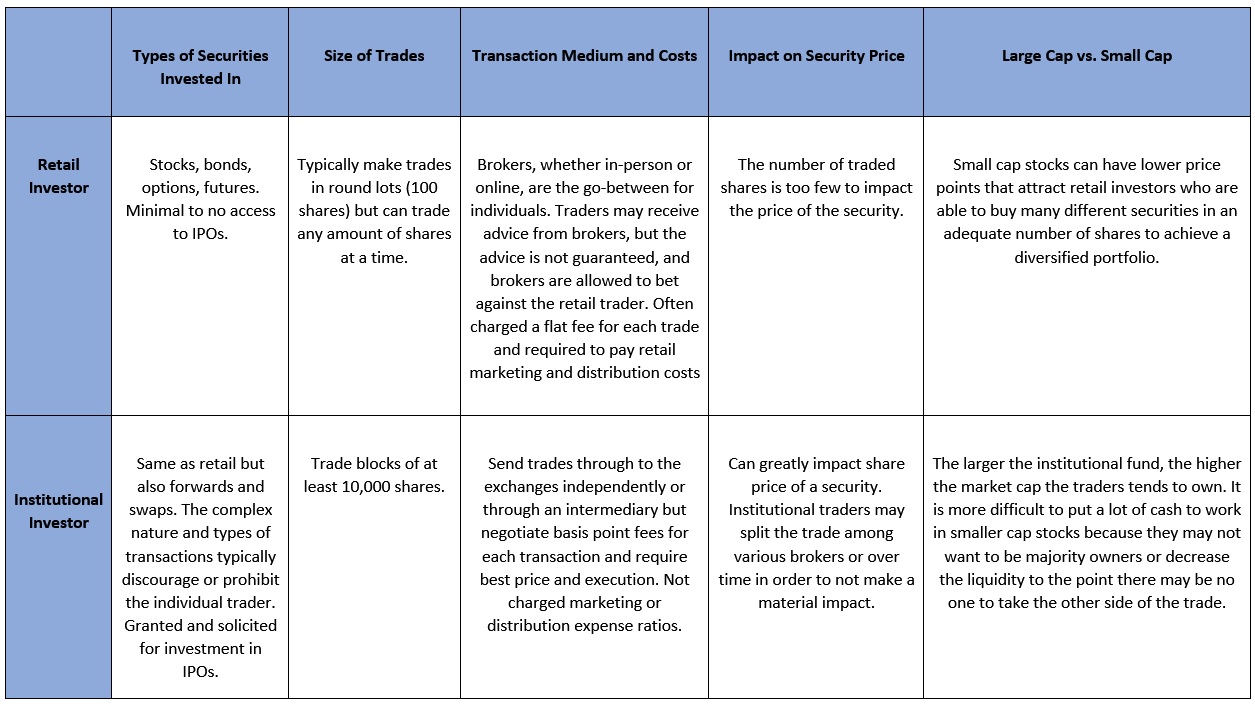

Here are the major differences between retail and institutional investors

Source: Investopedia

NEBA Financial Solutions creates tailored-made Structured Notes that’s suitable for both Retail and Institutional investors.

Visit www.nebafinancialsolutions.com to see our Structured Products and UCITS Funds https://www.nebafinancialsolutions.com/Risk-Rated-Portfolio-DFM, https://www.nebafinancialsolutions.com/real-asset-fund

- 19 Jul, 2018

- NEBA Financial Solutions

- 0 Comments

- Institutional investors, Investing, investor, Retail Investors, Structured Notes, Structured Products,

Comments