- 13Jun2018

-

2018 World Cup – Will It Boost The Russian Stock Market?

In case you have been living under the rock lately, the world’s biggest single sporting event, the FIFA World Cup, is about to kick-off this week.

To get an idea of just how huge it is, consider this: The Super Bowl, which is the largest sporting event in the U.S., attracted around 114 million viewers in its record-setting year of 2015.

The 2014 FIFA World Cup Final, which saw Argentina face Germany, drew about 1 billion viewers from around the world. And that was for just one game of 64.

Given the huge masses of viewership it gathers, it’s enticing to examine the market implications of the tournament.

So, let’s take a look at the performance of the markets of World Cup hosts – and what it could mean for this year’s host, Russia.

Host country markets before the whistle

Before one of these events, there’s a lot of excitement and anticipation. There’s also an impact on the local economy, as the country prepares to host floods of tourists – after investing potentially huge sums of money in infrastructure like stadiums and transportation. So how does that country’s stock market usually fare?

An independent investment research company, Stansberry Churchouse has conducted a research and here’s what they have found out…

The table below shows the market returns for the host of the World Cup the year of the tournament (starting in January and up until kickoff) going back 25 years, compared to the returns of the MSCI All Country World Index (ACWI), a global stock market index.

(Of course, 25 years isn’t a lot of data… and there are lots of factors that can affect stock prices that have nothing to do with football.)

On average, the host country market has outperformed the index. The average return for the host country during the year of the World Cup was 14.9%, compared to 2% for the index.

In total, 6 host countries out of 7 (Japan and South Korea co-hosted the World Cup in 2002) outperformed the index. For example, in 1998, France hosted the World Cup. In the lead up to the event, French shares outperformed the MSCI ACWI with a 40.7% return versus just 13.6%.

So far, Russia (the host of this year’s event) has also outperformed the index – although not by a big margin. Russian shares are up around 3% compared to 1.6% for the MSCI ACWI index.

So what about during the event?

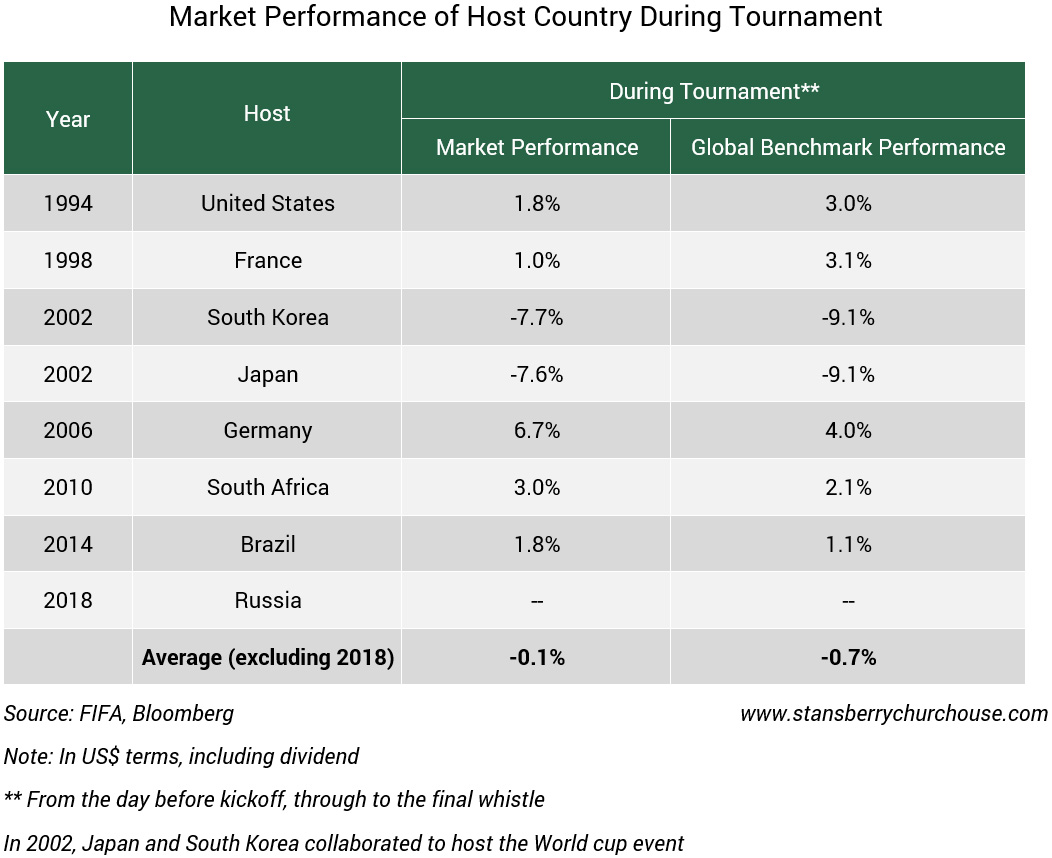

As you can see in the following table, on average, the host countries only marginally outperformed the MSCI ACWI index from the day before kickoff through the final whistle (returning a loss of 0.1% compared to a loss of 0.7% for the index).

Some host countries outperformed better than others. For example, Germany returned 6.7% during this time, compared to 4% for the index. And South Africa returned 3%, compared to 2.1%.

Meanwhile, the stock markets of U.S. and France underperformed the index during their tournaments.

According to the table above, the excitement of the Word Cup while it’s taking place doesn’t seem to have a significant impact on the host country. And it doesn’t last after the event is over. Based on the research, the company found on average, the markets of host countries underperformed (returning around 0%) the MSCI ACWI index (which returned 1.8%) after the final whistle through the rest of the year.

So if a host country’s market is going to see a bump from the World Cup, it’ll likely be before the Cup even begins.

And if you think about it, it makes sense. The actual economic impact of a World Cup comes from investment in infrastructure – building stadiums and roads and trains to support the brief but intense upsurge in tourism – in a host country. That’s the real tangible effect. That’s why you’ll see the biggest outperformance in the host country leading up to the tournament.

Of course, there will be less impact on a large economy, or one that already has the infrastructure, like when the U.S. hosted in 1994 (it had a 0.4% loss leading up to the tournament).

So while Russia has likely seen most of its gains from hosting, it could be worth keeping an eye on the host of the next World Cup in 2022 – Qatar.

Read original article here

Visit www.nebafinancialsolutions.com to see our Structured Products and UCITS Funds https://www.nebafinancialsolutions.com/Risk-Rated-Portfolio-DFM, https://www.nebafinancialsolutions.com/real-asset-fund

- 13 Jun, 2018

- NEBA Financial Solutions

- 0 Comments

Comments