Investment Objective

NEBA’s Model Portfolio Solution will divide your capital investment into a range of building block UCITS Funds. The percentage of your capital suggested for each fund will be in line with your attitude to investing. (CLICK the portfolios to the RIGHT to see what allocation you should have in each Fund)

These UCITS Funds target cash plus returns, meaning the investment portfolio strategy has an absolute benchmark and objective. Each building block fund brings exposure to different asset classes and strategies meaning overall your portfolio is invested in a wide range of investments to improve diversification and smooth out investment returns. Given that the model portfolio strategy targets cash plus returns over a full market cycle, many of the investments are less correlated to stock markets and their returns are not driven by the same investment conditions.

These UCITS Funds can also be invested into individually or you can use the recommended allocation to each Fund depending on your investment attitude. e.g. Adventurous, Balanced, Cautious etc…..

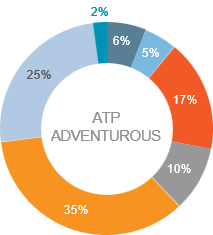

Suitable for investors willing to accept a much higher level of risk on their investments in return for potentially, higher returns in the longer run. Investors in this strategy are willing to accept what might be significant short-term fluctuations in the value of their investments as a result. They would feel comfortable if their investments fell in value more than 6 months in any one year and might well see this as an ideal time to invest more. This strategy will maintain a higher exposure to more volatile investments, including equities and commodities.

1M LIBOR +3.5%

Global Corporate Bond Index plus 1%

Medium – High

Investment Time Horizon:

6 years

Suitable for investors who are taking income or close to retirement and who seek stable yield and distributions from their portfolio but are willing to forego possible higher returns in interests of preserving capital and less volatility. Returns from this strategy should be slightly better than those available from a high street deposit account over a 5 year period, although the value of the investment could fall as well as rise. Investors in this strategy would feel uncomfortable if their investments rose and fell in value rapidly. This strategy will maintain a broad spread of income-generating investments, including higher exposure to less volatile asset classes such as money market funds, government and index-linked bonds, convertibles, assetbased securities, commercial property etc, to help guard against significant falls in financial markets.

1M LIBOR +3%

Global Corporate Bond Index

Medium

Investment Time Horizon:

5 years

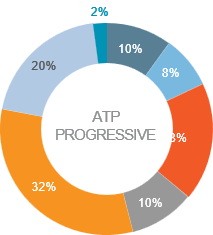

Suitable for investors who are seeking longer-term growth potential with at least a medium-term time horizon and who are prepared to accept a moderate level of volatility of returns as the price for potential growth. This strategy is designed to balance risk and reward and is appropriate for investors looking for higher returns than those available from a high street over a five year period account and willing to accept a certain amount of fluctuation in the value of their investments as a result. Investors in this strategy would feel uncomfortable if their investments were to fall significantly in value in any one year. This strategy will maintain a broad spread of assets, but with a greater emphasis on equities.

1M LIBOR +2.5%

Global Corporate Bond Index

Medium

Investment Time Horizon:

5 years

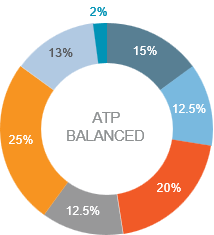

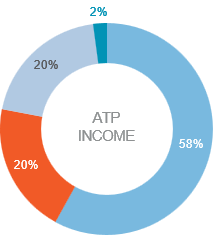

Suitable for investors who are taking income, and who seek stable yield and distributions from their portfolio but would prefer or need their portfolio to maintain some growth potential. Investors accept though, that will be greater volatility in returns for that growth. Returns from this strategy should be better than those available from a high street deposit account over a 5 year period, although the value of the investment could fall as well as rise. Investors in this strategy would feel uncomfortable if their investments rose and fell to an extent which mirrors global equities. This strategy will maintain a spread of income-generating investments, including exposure to less volatile asset classes such as government and index-linked bonds, global corporate bonds, however, will also keep exposure to higher yielding global equities which offer some growth potential beyond their dividend income.

1M LIBOR +2%

Global Corporate Bond Index less 1%

Low – Medium

Investment Time Horizon:

5 years

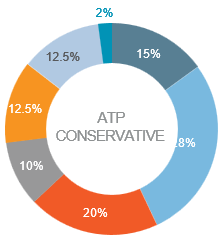

Suitable for investors who are conservative by nature or close to retirement and who seek steady growth but are willing to forego possible higher returns for steady performance and less volatility. Returns from this strategy should be better than those available from a high street deposit account over a 5 year period, although the value of the investment could fall as well as rise. Investors in this strategy would feel uncomfortable if their investments fell significantly in value in any one year. This strategy will maintain a broad spread of investments, including higher exposure to less volatile asset classes such as fixed income and absolute return strategies to help guard against significant falls in equity markets.

1M LIBOR +1%

Global Corporate Bond Index

less 2%

Lower

Investment Time Horizon:

5 years

Suitable for investors who are taking income or close to retirement and who seek stable yield and distributions from their portfolio but are willing to forego possible higher returns in interests of preserving capital and less volatility. Returns from this strategy should be slightly better than those available from a high street deposit account over a 5 year period, although the value of the investment could fall as well as rise. Investors in this strategy would feel uncomfortable if their investments rose and fell in value rapidly. This strategy will maintain a broad spread of income-generating investments, including higher exposure to less volatile asset classes such as money market funds, government and index-linked bonds, convertibles, assetbased securities, commercial property etc, to help guard against significant falls in financial markets.

1M LIBOR +1%

Global Corporate Bond Index

less 2%

Lower Suggested Minimum

Investment Time Horizon:

5 years

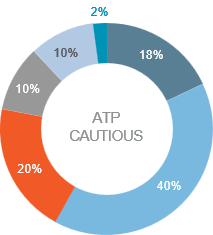

Suitable for investors who are cautious by nature or close to retirement and who seek steady growth but are willing to forego possible higher returns for steady performance and less volatility. Returns from this strategy should be slightly better than those available from a high street deposit account over a 5 year period, although the value of the investment could fall as well as rise. Investors in this strategy would feel uncomfortable if their investments rose and fell in value rapidly. This strategy will maintain a broad spread of investments, including higher exposure to less volatile asset classes such as money market funds, government bonds and absolute return strategies to help guard against significant falls in equity markets.

Key Features

• Gains exposure to a range of alternative investment strategies, targeting limited correlation with stock markets

• Investment universe includes emerging market equities, currencies, commodities, volatility, precious metals and managed futures

• Portfolio includes exposure to alternative strategies such as emerging markets, managed futures and gold

• Would be considered a multi-strategy approach as compared to a multi-asset fund

•Global equity fund with a mid cap bias from UK, European and US markets

• Quantitative stock selection identifies 60 companies globally which has demonstrated sustained

outperformance over a given time period

• Actively rebalanced monthly to consistently cycle into outperformers

• Portfolio has high beta and high growth characteristics

• Proprietary dynamic hedging technique which reduces market exposure as equity market volatility

increases

• The Fund seeks to deliver positive absolute returns by taking long and short positions in equity and equity-related instruments that, based on proprietary quantitative models.

• Companies deemed to be ‘poor quality’ become short positions, and ‘high quality’ companies the long exposures.

• The Fund seeks to provide higher risk-adjusted returns with lower volatility compared to global equity markets:

• Strategic market-neutral, long/short and stock selection portfolio

• Disciplined, systematic approach to stock selection equity markets

• Tactical tilts to the Fund’s equity market exposure throughout market cycle

• International equity universe is ranked according to ‘quality’ indicators which seek to identify

companies with strong, consistent profitability and stable earnings

The Parala Macro Multi-Asset (MMA) portfolio strategies are diversified, actively managed multiasset portfolios, with a focus on providing returns above the industry average benchmark. Parala’s Macro-Alpha Model generates forward-looking rankings for each asset and an optimisation framework to determine optimal weights. Using monthly inputs for both macroeconomic and risk factors it identifies the sensitivity of each asset to changing macro-conditions and their exposure to risk factors. This in turn generates a forward-looking estimate of return, volatility and covariance for each asset allowing the model to determine optimal asset weightings.